YINTAI

EN | 中文

- ABOUT US

- OUR BUSINESS

- SOCIAL RESPONSIBILITY

- NEWS CENTER

- JOIN US

- En|中文

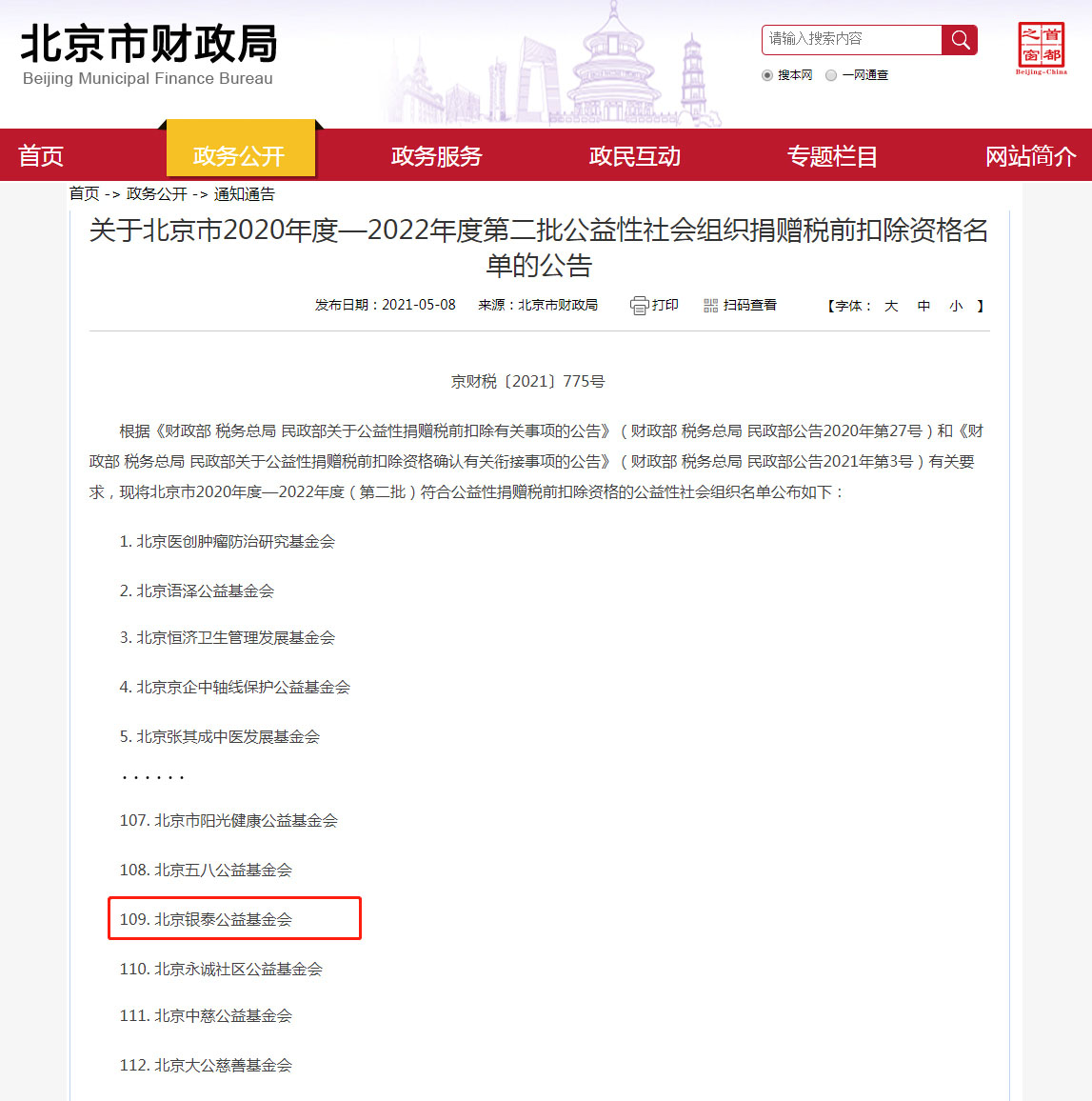

Recently, Beijing Municipal Finance Bureau, Beijing Municipal Tax Service, State Taxation Administration, and Beijing Municipal Civil Affairs Bureau jointly issued the Notice on the List of the Second Batch of Non-profit and Charitable Social Organizations Eligible for Tax Deduction from Taxable Income related to Charitable Donations for 2020-2022 (Beijing Finance and Tax 〔2021〕No. 775). Yintai Foundation qualified for eligibility for tax deduction from taxable income related to charitable donations for 2020-2022.

According to the relevant regulation, natural persons, legal persons and other organizations that donate their assets for the purpose of charitable and philanthropic activities by way of Yintai Foundation will be eligible for this preferential tax measure.

Yintai Foundation has, since its inception, promoted the development of strategic public interest and philanthropic undertakings based on the public interest concept of platform thinking and shared value. It was the first in China to sponsor and establish a master’s program in social enterprise management to develop talent for the public interest and philanthropic sector. In the field of environmental conservation, the Foundation funds public nature reserves, and is a sponsor for developing ocean conservation talent for the “Blue Pioneers” program. It also supports academic research and the grooming of young scholars in the study of modern and contemporary Chinese history. In terms of livelihood poverty alleviation, it has helped lift Zhenxiong County in Yunnan Province out of poverty. Going forward, Yintai Foundation will continue to leverage its advantages and resources to continue to contribute to non-profit undertakings.