YINTAI

EN | 中文

- ABOUT US

- OUR BUSINESS

- SOCIAL RESPONSIBILITY

- NEWS CENTER

- JOIN US

- En|中文

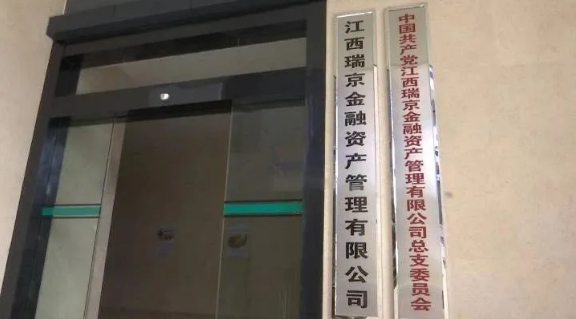

Ever since its expansion into Ganzhou in January 2018, Jiangxi Ruijing Financial Asset Management Co., Ltd. has always adhered to its business philosophy of “striving to be a first-class enterprise through professionalism, prudence, innovations, aspirations, diligence and cost efficiency” and created a professional team with “excellent calibre, abundant assets at its disposal, outstanding operational capabilities, excellent communication and negotiation expertise, and adherence to bottom line of risk management”. By doing so, it has supported economic development in Ganzhou and helped address regional financial risks. With the approval from Jiangxi Provincial People’s Government, registered capital of RMB1.5 billion, Jiangxi Ruijing Financial Asset Management Co., Ltd. was incorporated in January 2018 by a consortium consisting of well-known private companies in China led by China Yintai Holdings Co., Ltd. and Ganzhou Development Investment Holding Group Co., Ltd. The firm filed with the China Banking and Insurance Regulatory Commission (CBIRC) in October 2019, becoming the second local asset management firm in Jiangxi Province and the only local asset management firm in Ganzhou to have filed with the regulator.

Since its establishment, the firm has invested in a total of 52 projects, with total revenue of RMB316 million, total assets of RMB2,888 million, and cumulative assets under management of RMB9,178 million, and total tax payment of RMB84.66 million. With a focus on its main business of non-performing assets, Jiangxi Ruijing Financial Asset Management Co. has been proactively involved in due diligence and bidding of banks’ non-performing asset tranches and teamed up with Jiangxi-based financial institutions to develop non-performing asset business. The firm has acquired 30% of total packaged non-performing assets sold in Jiangxi Province since the beginning of this year.

At the same time, the firm leveraged its expertise to help alleviate pressures on banks in relation to non-performing loans and other metrics, reduce enterprises’ debt ratios, help struggling enterprises stay afloat, and aid enterprises’ mixed-ownership reform and divestment of unproductive assets. The firm also established a division dedicated to advancing debt-to-equity swap projects. On July 20, 2018, the firm signed a RMB10 billion Framework Agreement on Debt-to-Equity Swap Implementation and Promotion with Ganzhou Development Investment Holding Group Co., Ltd.

Building on its traditional business, the firm has also proactively developed specialty businesses, creating a set of intelligent risk control system suitable for micro and small-sized enterprises (MSMEs) grappling with financing difficulties and challenges to access loans. The system helps realize full-process risk management of “pre-lending analysis and review + ongoing dynamic tracking + post-lending management and disposal”, ensuring pre-lending risk prevention and post-lending asset acquisition. Equipped with the system, the firm has been able to provide diversified and integrated financial services to MSMEs.

Since the outbreak of COVID-19, Jiangxi Ruijing Financial Asset Management Co has fulfilled its social responsibilities by assisting with the epidemic fight. By firmly upholding the idea that “when an epidemic breaks out, a command is issued and it is our responsibility to prevent and control it”, the firm has given full play to the exemplary role of party members and cadres and led all employees to implement preventative measures against the epidemic in every aspect of its operations.

By upholding a high level of social responsibility, the firm has launched “Ruijing Anti-epidemic Support Pass” financial support program for some companies across the real economy in Ganzhou. “Ruijing Anti-epidemic Support Pass” adopts the business model based on “acquisitions of non-financial enterprises’ debt”. It provides liquidity support to micro, small, and medium-sized enterprises through acquisitions of various accounts receivable claims. After the product was launched, the firm received applications from more than 10 Ganzhou-based companies affected by the epidemic. And to address the funding issues facing companies directly engaged in epidemic fight, the firm plans to offer “anti-epidemic special bonds” via private placement, with proceeds tapped to support production of anti-epidemic products and relevant service providers.

Going forward, Jiangxi Ruijing Financial Asset Management Co will strictly comply with the CBIRC’s regulatory requirements, focus on developing the non-performing asset market, and pursue innovations tied to its business model of non-performing asset disposal, in a bid to strengthen, refine, and grow its main business of non-performing assets. By stepping up investments in local non-performing asset business and exploring operations of non-performing financial assets across the entire value chain, the firm is committed to providing high-quality financial services to enterprises as a “financial stabilizer”, thereby bolstering Ganzhou’s real economy.

In addition, it will also provide restructuring services, i.e., debt restructuring, asset integration, and restructuring of troubled companies, to help companies in difficulty improve their debt solvency and resume production and operation, thereby facilitating the transformation of non-financial enterprises in Jiangxi. The firm will actively respond to provincial and municipal governments’ calls for integration into the Guangdong-Hong Kong-Macao Greater Bay Area by closely working with well-known fintech companies in the greater bay area and assisting in the efforts to build a financial service system compatible with the greater bay area, thereby supporting Ganzhou’s high-quality economic growth.